Where should I Invest ??

Okay so where do we start and which one should we vindicate. I mean surely we need to make you do that next transaction in favor of the bank manager, crypto dealer, wealth manager or property agent.

Well someone must benefit so it might as well be you.

As you are the one that is investing that hard earned money.

Well actually if it was as simple as that to just make a decision, or simply give advice, which then would be the perfect choice investment?

Obviously as you know it is not as simple as that because life is life and it happens daily. It has the ability to change with time so I will try my best to give the appropriate answers.

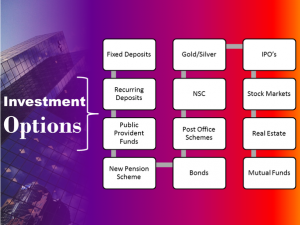

So here is my thought where I should Invest

And so if I were sitting in front of that young couple or single adult of about 25 who had just begun his or her career I would be telling them to take a little risks. Maybe just a few more than usual. I would suggest put all effort into saving through crypto and stocks to have enough in 5 years for that property investment deposit. As well a small portion through bonds and stocks towards pension savings and let it grow for the next 40 years. Remember at this age disposable income is normally at its highest percentage. Oh, and don’t forget to have an emergency fund sitting in the bank enough to cover 3 to 6 months of monthly expenses.

Well that was easy and simple.

And as the young adults begins to reach 40 or 45 their kids are nearing university. They are glad they never stopped saving after the house was bought and therefore had enough to get the children a decent education. But now their perspective begins to change, and a little less risk is taken. They are still paying for their property and decide to bolster their pension preferably by stocks and although they have had success in the crypto arena, they are looking for a stable income in 20 years. So crypto has taken a back seat representing about 5 to 10% of investing and the balance split between the property payment and pension savings in stocks and bonds.

Off course I am assuming that the young adult was contributing together with their employer about 10 to 15 % of their monthly income towards a pension fund.

Well the above scenario was obviously the perfect one.

Not yours?………So, then what should you do?

Well that is easy to answer.

Firstly, create and be strict on a Budget.

Cut out all debt and save as much of your disposable income as possible in predominantly stocks

And still off course purchase that property.

Also I am not excluding crypto here.

However remember when you have run out of time and it is not on your side the best is the tried and tested investing.

But please start today because it is procrastination that has left you in this situation.

Take lesser risks with your investments and review regularly to make sure that you are always on track to reach those savings goals.

So my final thoughts then but this is not a comprehensive list.

Bank savings should always equal 3 to 6 months of your monthly expenses but not more than that.

Crypto investing will require you to study investing and give plenty of time or you could suffer losses.

Stocks will require you to study investing and give plenty of time or otherwise employ a Wealth Manager.

Property investing requires you to purchase as if you will be renting it out later on.

Moneywize with Brian has a powerful Financial Literacy Course that would cover all these areas.

Check the introductory video

Author

-

Brian has been successfully advising clients in the property and finance business for the past 3 decades. Helping investors to create winning and growth portfolios. A real focus on service,

View all posts