Best returns on your investments. Can it be achieved??

Okay so you opened this, and I am sure you are curious.

Therefore, which are the 5 ways to make the best returns on your investments.

So, firstly “Best Returns” are relative to each person and the situation that they find themselves in. In other word’s you need to consider your appetite for risk, your age as well as the term for that investment goal.

GREAT now I just said nothing that you did not already probably know.

But it is the truth of the matter. However, let me define it with a bit more real-life emotion.

I consult with about 15 people a week around investing which entails “determining the risk factor” as the starting point. These questionnaires are so important for compliance. However, when I delve deeper there are sometimes other factors that influence what clients feel. As well what they ultimately want and lastly need when it comes to investing.

So, I always say as a Wealth Manager when helping and advising clients. “It’s not all about my best or favorite Stocks, Index Funds, Bonds or Block-chains. But rather its 50% you as a person that determines really the correct choice.

In other-words I really need to listen and hear you so that I can apply my skills as an investment manager. It is not a “one shoe fits all”.

So here is the secret to great investing:

“Have funds with best returns on your Investments with no costs and no risks”

Well, don’t we all want that!!

So, let’s tackle the secret to the best returns on your investments and great investing.

Firstly, high returns and no costs are not possible for it does not matter which system you utilize there will be costs even if they are smaller.

If you are concerned about an extra 1% above the average Stock Market cost, then going to the Stock Market yourself is the answer here. But you need knowledge in choosing the correct strategy as well as the correct stock and bond allocations. Furthermore, you need time to achieve this as well as time to monitor this.

Only 10% succeed at this 50/50 game. Yes, a 90% chance of failure.

I am not saying that this is not what you should do but rather just not attempt it with all your investment. Of course, if you really are qualified and have the time that could be different.

Secondly, a high return and no risk is not possible. Although higher returns and lesser risks are assisted by a longer term of your investment.

Okay so since inflation is lurking around about 2% per year, I would strongly suggest that you aim at about a minimum 7% returns before costs.

Is this achievable??

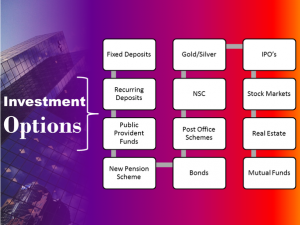

Okay so let’s weigh up the options then and see what the 5 things are to do to get these best returns and answer “Yes” to achievable:

Determine your Investment Goal

In other word’s you need to consider very clearly what amount of Cash it is that you are trying to accumulate and in what time period.

Once you have this figure, taking inflation into account off course you simply work back from there which will let you know what it is that you need to invest on a monthly basis or in a once off lump sum, taking again into account the interest expected to be earned.

I meet so many people that are blindly saving having in mind that it’s for pension, a child’s education or a new home but have no idea actually what that saving amount is going to actually achieve. Yes, it is better than doing nothing at all and getting a good surprise in the end hopefully. Planning for your future although must eradicate the word “hopeful”.

Okay so now you know what it is that you are striving to achieve.

The next step to achieving the best returns on your investments is;

2. Determine your Strategy for Best Returns on your Investments

This evolves around your RISK that you are prepared to take when investing. Which normally is the same as your personality or character in life. Are you a risk taker, a conservative type of person or just somewhere in-between?

Although having said that there sometimes are mitigating circumstances that can affect this norm. For example, you left it to late in life to plan for retirement and your term is short and funds are a little limited. Maybe the opposite is the case where you planned exceptionally well and have little to achieve with quite some time on hand and so why take unnecessary risks.

Once you have determined your strategy you need to stick to it. For it is entirely possible for a smart and patient investor to beat the market over time.

I always say you need a minimum of 5 years to achieve the best returns on your investments.

Okay so let me use some examples with Points 1 & 2 mixed.

A) Client has 10 years to retirement and needs a further $500000 capital to be gathered for pension. This capital is not crucial because it will constitute only between 20 to 30% of there pension. Therefore, no high risks need to be taken but rather a medium risk at $3000 pm contribution should comfortably reach the target.

b) Client has 10 years to pension and has no pension accumulation at this point. Then the Client has no option but to pay into a fund their full monthly income every month for the next 10 years. If not, they could pay a Lump Sum of 10 x there annual into a fund with a mixture of stocks and bonds. I know this sounds impossible, but you are not giving compound interest time to work.

c) Client has 30 to 35 years to go and is living Internationally and contributing to a company pension fund. Then only about 10% extra of monthly income earned needs to be contributed towards a pension fund. If the time is shorter than that then the % obviously climbs and the strategy could change.

So YES, the strategy needs to be carefully thought through and planned well. Discipline is an ingredient that needs to be added to achieve the goal.

Okay so I have my Strategy so what is next?

3) Determine Your Asset Allocation for Best Returns on Your Investments

So, if you are not the 10% that is, that fortunate and beating the stock market on your own then the better option is to choose to invest in actively managed funds or passive funds.

As said before it is the term, your particular risk tolerance and as well your investment objectives that will determine your Asset Allocation.

The general thought is that as you grow older, stocks become a less desirable place to place your investments. However when you are young, you have plenty years ahead of you to ride out any upsets and gains in the market. Therefore this is probably not the case if you’re retired and reliant on your investment income.

So the rule of thumb (but not a scientific theory), that could help you establish an average asset allocation is the following.

“Therefore take your age and subtract it from 110 giving you the % needed in stocks. In other words, if you are 40 years of age then 70% should be invested in stocks and 30% in bonds”. (Adjusted up and down depending on risk appetite).

But please remember this is only if your investment strategy is running 100% correctly. That you are on target with all your financial goals otherwise you might need to add more stocks in to meet your desired target.

As you can see above this is not a straightforward exercise.

4. Start

The interesting thing is that you have read the above and said I know all or most of what you have said. But unfortunately, the stats lately done in US is that 1/3 of retired people are concerned of there pension status financially. In another survey done 20% respondents had not a cent saved for pension. While in another survey over 40% had less than $10000 (lets call that “not substantial savings”).

And so if you know for a fact you will be comfortable at pension stage then this article might not apply to you. Although you might have other financial goals which require the same “call to action”

Yep, stop procrastinating and START

5. Review and Continue to achieve the best returns on your Investments

So yes, the heading says it all. Make sure you follow through with investing and review continually (every 6 or 12 months), Check you are on target, so that if adjustments need to be made you can do so. The purpose is to meet the end goal.

So therefore, in summary if you are going to achieve the best return on your money you need to:

Set a Goal and know your Strategy and Asset Allocation.

And.

Keep in mind to start, and not stop, while evaluating all along.

I know it sounds simple, but it is about doing the simple basics that gets the results.

Therefore this is not an A-Z and perfect science or full thesis to achieving the best returns on your investments, but a basic overview.

Always Remembering that personal circumstances, risk tolerance as well as time, will influence the Investment Strategies, the Allocations, the Terms and the Amounts.

Author

-

Brian has been successfully advising clients in the property and finance business for the past 3 decades. Helping investors to create winning and growth portfolios. A real focus on service,

View all posts