College savings is the responsibility of every parent to not just consider but to action.

Therefore college savings prepare you so that you are able to comfortably give your child the best education possible.

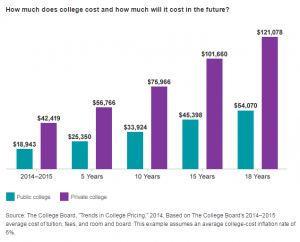

If you’re a parent, you’ve probably heard the mantra that education is the key to a successful future for your child. You’ve probably also heard about the skyrocketing costs of a college education.

There are savings for so many things and somehow with many of us somehow, we put this one on a back burner. Leaving it until a year or 2 before our child needs to go to college.

One survey found that 70% plan to pay the full cost of college for their children. However less than 30% are on the path to making that a reality. Another study reported that 45% of parents with a child under 18 have not yet started saving for their college education.

Firstly then, like anything Financial you need to begin with the end Goal in mind. Yes, it is called a “Plan”. Compound interest over time will make your initial contribution substantially smaller that would be needed from the outset.

As well many investors have got to the end of saving for a goal and said, “but that is not enough”. Or otherwise “if somebody had told me I would have saved more”.

So, make sure you know your end Goal before starting. Off course you might not get it perfectly correct. However college savings prepare you to get as close as possible to what you need. It’s not easy, but with focused commitment and careful planning, it’s possible.

Why not save enough so that your child can get through college debt free.

Therefore, if you truly want to give your child the gift of a college education and free from overwhelming student debt, the time to plan is NOW.

Author

-

Brian has been successfully advising clients in the property and finance business for the past 3 decades. Helping investors to create winning and growth portfolios. A real focus on service,

View all posts